Discover How a Home Loan Calculator Can Streamline Your Mortgage Planning

Discover How a Home Loan Calculator Can Streamline Your Mortgage Planning

Blog Article

Cutting-edge Car Loan Calculator: Empowering Your Budgeting Techniques

In the realm of personal finance, the significance of reliable budgeting methods can not be overstated. An ingenious funding calculator stands as a device that not just facilitates the understanding of numerous financing options however likewise aids in understanding elaborate repayment routines. Nonetheless, its influence goes beyond mere mathematical computations; it plays an essential function in keeping track of one's financial health and, eventually, in optimizing budgeting strategies. By utilizing the power of easy to use functions, this calculator leads the means for a more educated and empowered method in the direction of managing finances. This tool's potential to change the way people navigate their economic landscape is indisputable, supplying a peek right into a realm where budgeting comes to be greater than just number crunching.

Comprehending Lending Options

When thinking about obtaining money, it is important to have a clear understanding of the different finance options available to make educated economic decisions. One typical type of lending is a fixed-rate car loan, where the rates of interest remains the exact same throughout the loan term, providing predictability in month-to-month settlements. On the other hand, adjustable-rate fundings have interest rates that rise and fall based upon market conditions, offering the possibility for lower first rates yet with the risk of raised payments in the future.

One more choice is a safe finance, which needs collateral such as a home or auto to secure the borrowed amount. This sort of financing normally provides lower passion prices as a result of the decreased risk for the lending institution. Unprotected loans, nonetheless, do not call for collateral yet usually featured higher rate of interest to make up for the enhanced threat to the loan provider.

Understanding these financing options is crucial in selecting one of the most suitable funding solution based upon financial circumstances and private requirements. home loan calculator. By considering the advantages and disadvantages of each sort of funding, consumers can make well-informed decisions that straighten with their lasting financial objectives

Computing Repayment Routines

To successfully handle lending settlement obligations, understanding and accurately computing settlement timetables is critical for maintaining monetary security. Determining repayment routines entails figuring out the amount to be paid off periodically, the regularity of repayments, and the complete duration of the car loan. By breaking down the overall car loan quantity into workable routine repayments, customers can spending plan efficiently and make sure prompt repayments, hence staying clear of late fees or defaults.

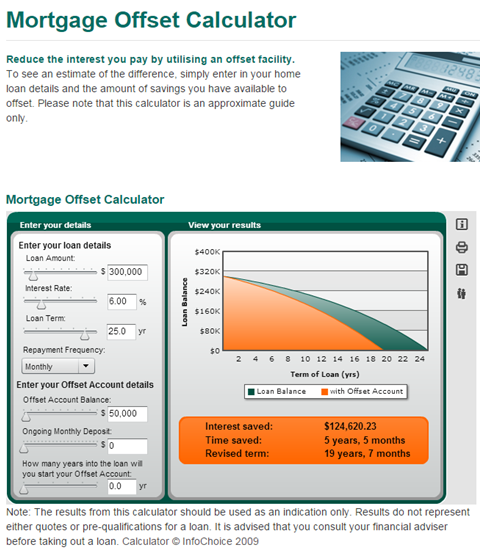

There are various techniques to compute repayment timetables, consisting of using funding amortization routines or on the internet loan calculators. Finance amortization routines supply an in-depth break down of each repayment, demonstrating how much of it goes towards the primary amount and how much in the direction of rate of interest. On the internet loan calculators simplify this procedure by enabling users to input car loan details such as the principal more helpful hints quantity, rate of interest rate, and loan term, generating a payment timetable instantaneously.

Recognizing and determining repayment schedules not only help in budgeting however additionally give consumers with a clear introduction of their economic commitments, allowing them to remain and make educated choices on track with their settlement responsibilities.

Surveillance Financial Wellness

Keeping an eye on economic wellness involves frequently analyzing and evaluating one's economic standing to make sure security and educated decision-making. By keeping a close eye on key financial signs, individuals can determine prospective concerns early on and take positive procedures to address them.

Routinely assessing financial investment profiles, retired life accounts, and emergency funds can aid individuals assess their progress in useful reference the direction of meeting monetary goals and make any type of essential adjustments to enhance returns. Monitoring financial obligation levels and credit rating scores is likewise crucial in evaluating total economic health and wellness.

Making The Most Of Budgeting Strategies

In maximizing budgeting approaches, individuals can take advantage of various strategies to enhance financial preparation and source allowance successfully. One trick approach to maximize budgeting approaches is with setting clear economic goals.

Furthermore, focusing on savings and financial investments in the budget plan can help people secure their economic future. By designating a portion of earnings towards financial savings or retirement accounts prior to other expenses, people can develop a safeguard and work in the direction of long-term financial security. Seeking specialist advice from financial coordinators or consultants can also assist in taking full advantage of budgeting strategies by getting tailored support and proficiency. Generally, by employing these methods and remaining disciplined in budget plan administration, people can successfully maximize their monetary sources and achieve their economic objectives.

Making Use Of User-Friendly Attributes

Verdict

In conclusion, the ingenious loan calculator provides a useful device for people to recognize lending choices, compute settlement timetables, display financial health, and take full advantage of budgeting approaches. With straightforward attributes, this device encourages individuals to make informed financial decisions and prepare for their future economic goals. By using the financing calculator effectively, individuals can take control of their finances and achieve greater financial security.

Keeping track of financial health involves routinely evaluating and evaluating one's monetary condition to ensure stability and informed decision-making. On the whole, by employing these methods and staying disciplined in budget management, individuals can efficiently optimize their financial sources and accomplish their monetary goals.

In verdict, the innovative finance calculator supplies a useful device for people to recognize car loan choices, compute payment schedules, screen economic wellness, and make best use of budgeting approaches. With straightforward functions, this device encourages individuals to make enlightened economic decisions and strategy for their future financial objectives. By making use of the funding calculator efficiently, individuals can take control of their financial resources and attain greater financial stability.

Report this page